|

|

Rental Market Conditions by Metropolitan Area; 2014 Update

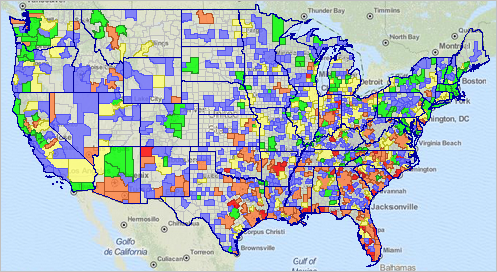

Use the interactive table in this section to view/rank/compare rental market conditions for metropolitan areas. We develop and analyze geographic drill-down demographic-economic estimates and projections to help stakeholders gain insights into the how, where, when and by how much change will occur and assess potential impacts. More information. This section updates Rental Market Conditions by Metropolitan Area; 2009. That section includes an interactive table with comparable subject matter by metro for 2009. See how characteristics have changed. National Housing Agenda. Rental housing is among the top items on the national housing agenda. The past 30 years have witnessed a housing policy that has been focused on promoting homeownership. The large gap between the number of renting households and the units that they can afford will grow as home ownership becomes increasingly scarce for all but the most qualified buyers and renter/owner preferences change. Rental housing is an important component of national and local housing policies. Rental Vacancy Rate by MSA 2012 This view shows the rental vacancy rate (RVR) in 2012 by MSA. Orange/red metros have higher RVRs, yellow metros are closer to the national RVR and green/blue metros have lower RVRs. Click graphic for larger view with details.

This view shows 521 metros (MSAs and MISAs) -- all 2010 vintage metros for which ACS 2012 1 year estimates were tabulated. See southeastern U.S. zoom-in view (shows mini-profile for Atlanta metro attributes). These views were developed using the CV XE GIS and metro GIS project. Members of the User Group may install the CV XE GIS and metro project and create related, augmented map views and perform related analyses. There is no fee. The rental vacancy rate is the percent of rental units that are unoccupied/available for rent. The rental vacancy rate is a factor in determining supply and demand in the rental market and is a component of the index of leading economic indicators. A high rental vacancy rate coupled with a low share of homes that are renter occupied generally implies more housing choices available for renting households. The share of burdened households can be lower in such markets. Conversely, a low rental vacancy rate in a market with a high percentage of renter households can signify a tighter rental market, fewer housing choices, and more affordability problems, particularly for low-income households. In these markets, the shares of burdened renters are often higher. This section builds on the related Census Bureau data and provides resources to examine characteristics of the rental housing market for individual and among states and metropolitan areas. Data are sourced from the most recent data available for all metros (ACS 2012 1 year estimates). These data update in September 2014. Contact us for information on annual/trend data and analyses. Rental Housing Market Measures (scroll section)

Housing Costs

In 2012, median gross rent in the metro areas (metropolitan statistical areas) in the United States ranged from $522 in the Wheeling WV-OH Metro Area and the Wheeling, WV-OH Metro Area to $1,560 in the San Jose-Sunnyvale- Santa Clara, CA Metro Area compared with the national median of $884. Among the 366 metro areas, 280 (76.5 percent) had a median gross rent below the national median, 86 (23.5 percent) had a median gross rent above the national median. A comparison of all metro areas to the national median masks the tighter rental conditions faced by renters living in higher density metro areas. Renter Burden Nationwide, nearly 2 in 5 renter households (43.1 percent) were burdened by housing costs consuming 35 percent or more of their incomes. Housing cost burdens ranged from a low of 25.7 percent of renting households in the Jefferson City, MO Metro Area to a high of 57.9 percent of renting households in the Corvallis, OR Metro Area. Many of the metros (metropolitan statistical areas) with the higher cost burden is due to a relatively large student population. Renters living in 166 of the 366 metro areas (45.4 percent) were above the national rate. Rental Vacancy Rate Nationwide, the rental vacancy rate was 6.8 percent. The rates in the nationís metro areas (metropolitan statistical areas) ranged from 0.3 percent in the Odessa, TX Metro Area to 38.1 percent in the Myrtle Beach-North Myrtle Beach- Conway, SC Metro Area. Excess rental inventory was almost equally likely to plague metro areas than the national rental housing market as a whole, with 180 (49.2 percent) of all metro areas having a rental vacancy rate below the national rental vacancy rate and 186 (50.8 percent) having vacancy rates at or above the national rate. Rental Market Conditions by State and Metro Interactive Ranking Table ... rank by column Click column header to sort; click again to sort other direction. See related Ranking Tables Main Page Usage Notes The table includes the U.S., states and all metros for which ACS 2012 1 year estimates were tabulated. By including all metros, MSAs or MISAs, the maximum number of metros are included. To select only MSAs, use "Metro" (case sensitive, without quotes) in the Find in Name edit box, then click Find in Name. • Click on a column header to sort on that column; click column header again to sort in other direction. • Click ShowAll button to show all areas and restore full set of data view. • Click State to view metros in a selected state (click ShowAll between selections). • Find by Name: key in partial area name in text box to right of Find-in-Name button then click button to locate all matches (case sensitive). • See related ranking tables. Column Headers All items are for calendar year 2012 • State - dominant MSA state • $MHI - median household income • OccHU12 - Occupied Housing Units • HUOwn12 - Occupied Housing Units, Owner Occupied • HURent12 - Occupied Housing Units, Renter Occupied • %HURent12 - Percent Renter Occupied Housing Units • $MdRent12 - Median Gross Rent • RentPd12 - Occupied Housing Units, Renter Occupied with paid rent • >35Pct - Renters spending 35% or more of income for gross rent • %>35Pct - Renters spending 35% or more of income for gross rent (percent) • RVacRate - Rental Vacancy Rate Terms and Definitions (scroll section)

Gross rent. The monthly amount of rent plus the estimated average

monthly cost of utilities (electricity, gas, water, and sewer) and fuels (oil, coal,

kerosene, wood, etc.).

Gross rent as a percentage of income. The ratio of gross rent to household income. It is used as a measure of housing aff ordability by policymakers and as a determinant of eligibility for federal housing programs and is often referred to as housing cost burden. A renting household is considered "burdened" if the household is required to spend 35 percent or more of its income on housing costs. Rental vacancy rate. The proportion of the rental inventory that is vacant "for rent." It is computed by dividing the number of vacant units "for rent" by the sum of renter-occupied units, vacant units "for rent," and vacant units that have been rented but not yet occupied, and then multiplying by 100. ProximityOne User Group Join the ProximityOne User Group to keep up-to-date with new developments relating to metros and component geography decision-making information resources. Receive updates and access to tools and resources available only to members. Use this form to join the User Group. There is no fee. Support Using these Resources Learn more about metros, metro geographic drill-down, housing market demographic economic data and related analytical tools. Join us in a Decision-Making Information Web session. There is no fee for these one-hour Web sessions. Each informal session is focused on a specific topic. The open structure also provides for Q&A and discussion of application issues of interest to participants. Additional Information ProximityOne develops geographic-demographic-economic data and analytical tools and helps organizations knit together and use diverse data in a decision-making and analytical framework. We develop custom demographic/economic estimates and projections, develop geographic and geocoded address files, and assist with impact and geospatial analyses. Wide-ranging organizations use our tools (software, data, methodologies) to analyze their own data integrated with other data. Follow ProximityOne on Twitter at www.twitter.com/proximityone. Contact ProximityOne (888-364-7656) with questions about data covered in this section or to discuss custom estimates, projections or analyses for your areas of interest. |

|

|