|

|

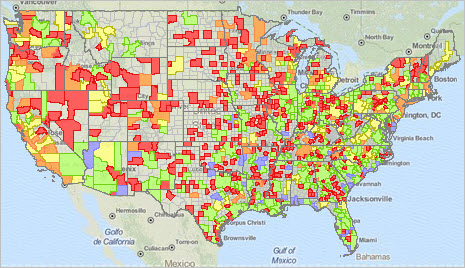

Rental housing is among the top items on the nation's housing agenda. The past 30 years have witnessed a housing policy that has been focused on promoting homeownership. The large gap between the number of renting households and the units that they can afford will grow as home ownership becomes increasingly scarce for all but the most qualified buyers and renter/owner preferences change. Rental housing is an important component of national and local housing policies. This section updates in June 2018. • Gaining Insights in Housing Prices, Conditions & Markets .. Characteristics, Patterns & Trends .. one hour web session -- overview & connectivity details Related Housing Market Data & Analytical Resources • Metro Situation & Outlook Reports - click link in column 3 to view that metro • 2010-2017 annual population estimates and trends • ACS 2016 1-year demographic-economic tables - metro/CBSA • Housing Price Index • ProximityOne Data Services: access/integrate these with other data • CV XE GIS software: data analytics, maps, geospatial analysis • See related Interactive Ranking Tables Using Tools & Data Resources in this Section Use tools in this section to examine the rental housing market by state and metro. View/rank/compare rental market conditions using the interactive table (see below). Use the GIS tools to visually and geospatially analyze patterns and characteristics of interest. Members of the ProximityOne User Group may download the Metro Rental Housing Market GIS project and datasets for use with the CV XE GIS software. Develop variations on maps shown in this section; add your own data. Metro Housing Market Reports Register for information on Metro Housing Market Reports. Updated quarterly, these reports provide a comprehensive housing market assessment and outlook for the U.S. by metro with geographic drill-down (tract and ZIP code) within individual metros. Rental Vacancy Rate by Metro 2014 This view shows the rental vacancy rate (RVR -- more about the RVR) in 2014 by metropolitan area. Blue/green metros have higher RVRs (above 6.3 the national RVR), yellow metros are just below the national RVR and orange/red metros have lower RVRs. Click graphic for larger view with details.  - view developed using CV XE GIS software and associated metro GIS project. Housing Costs. In 2014, median gross rent in the metro areas (see about metros & and data) in the U.S. ranged from $533 in the Greeneville, TN metro to $1,779 in the San Jose-Sunnyvale- Santa Clara, CA metro Area compared with the national median of $934. Among the 508 metro areas, 413 (81.3 percent) had a median gross rent below the national median, 95 (18.7 percent) had a median gross rent above the national median. A comparison of all metro areas to the national median masks the tighter rental conditions faced by renters living in higher density metro areas. Renter Burden. Nationwide, nearly 2 in 5 renter households (42.6 percent) were burdened by housing costs consuming 35 percent or more of their incomes. Housing cost burdens in the 508 metros ranged from a low of 19.5 percent of renting households in the Marshall, TX metro to a high of 62.2 percent of renting households in the Clearlake, CA metro. Many of the metros with the higher cost burden is due to a relatively large student population. Renters living in 212 of the 508 metro areas (41.7 percent) were above the national rate. Rental Vacancy Rate. Nationwide, the rental vacancy rate was 6.3 percent. The rates in metros ranged from 0 percent in the Marinette, WI-MI metro to 45.3 percent in the Daphne-Fairhope-Foley, AL metro. Excess rental inventory was almost equally likely to plague metro areas than the national rental housing market as a whole, with 232 (45.7 percent) of all metro areas having a rental vacancy rate below the national rental vacancy rate and 276 (54.3 percent) having vacancy rates at or above the national rate. Rental Vacancy Rate by Metro 2014 -- Southeast U.S. The graphic below shows the rental vacancy rate (RVR) in 2014 by metropolitan area zoom-in to the southeast. The Atlanta metro is shown with bold brown boundary Orange/red metros have higher RVRs (above 6.3 the national RVR), yellow metros are closer to the national RVR and green/blue metros have lower RVRs. Click graphic for larger view with details and view of mini-profile for the Atlanta metro. Develop zoom-in maps similar to this view for any area using the GIS project.  - view developed using CV XE GIS software and associated metro GIS project. 2014 Rental Market Conditions by State and Metro Interactive Ranking Table Click column header to sort; click again to sort other direction. Initial view order: U.S., states, metros. See usage notes below table. See related Ranking Tables Main Page Usage Notes The table includes the U.S., states and all metros for which ACS 2014 1 year estimates were tabulated. By including all metros, MSAs or MISAs, the maximum number of metros are included. To select only MSAs, use "MSA" (case sensitive, without quotes) in the Find in Name edit box, then click Find in Name. • Click on a column header to sort on that column; click column header again to sort in other direction. • Click ShowAll button to show all areas and restore full set of data view. • Use horizontal scroll bar at base of table to scroll left-right. scroll all the way right to view rental vacancy rate. • To view geographies in one state: select state in dropdown below table; click ShowAll between selections. • Find by Name: key in partial area name in text box to right of Find-in-Name button then click button to locate all matches (case sensitive). • See related ranking tables. Column Headers All items are for calendar year 2014 • State - dominant MSA state • $MHI - median household income • Occ Hsg Units - Occupied Housing Units • Owner Occupied - Occupied Housing Units, Owner Occupied • Renter Occupied - Occupied Housing Units, Renter Occupied • %Renter Occ - Percent Renter Occupied Housing Units • $Median Rent - Median Gross Rent • Paid Renter Units - Renter Occupied Housing Units, Renter Occupied with paid rent • >35Pct Income - Renters spending 35% or more of income for gross rent • %>35Pct - Renters spending 35% or more of income for gross rent (percent) • RVR - Rental Vacancy Rate Terms and Definitions (scroll section)

Housing Costs/Gross rent. The monthly amount of rent plus the estimated average

monthly cost of utilities (electricity, gas, water, and sewer) and fuels (oil, coal,

kerosene, wood, etc.).

Housing Cost Burden/Gross rent as a percentage of income. The ratio of gross rent to household income. It is used as a measure of housing affordability by policymakers and as a determinant of eligibility for federal housing programs and is often referred to as housing cost burden. A renting household is considered "burdened" if the household is required to spend 35 percent or more of its income on housing costs. Rental vacancy rate. The proportion of the rental inventory that is vacant "for rent." It is computed by dividing the number of vacant units "for rent" by the sum of renter-occupied units, vacant units "for rent," and vacant units that have been rented but not yet occupied, and then multiplying by 100. The rental vacancy rate is the percent of rental units that are unoccupied/available for rent. The rental vacancy rate is a factor in determining supply and demand in the rental market and is a component of the index of leading economic indicators. A high rental vacancy rate coupled with a low share of homes that are renter occupied generally implies more housing choices available for renting households. The share of burdened households can be lower in such markets. Conversely, a low rental vacancy rate in a market with a high percentage of renter households can signify a tighter rental market, fewer housing choices, and more affordability problems, particularly for low-income households. In these markets, the shares of burdened renters are often higher. Metros and Core-Based Statistical Areas [goto top] Metropolitan Statistical Areas (MSAs) and Micropolitan Statistical Areas (MISAs) are geographic entities delineated by the Office of Management and Budget (OMB) for use by Federal statistical agencies in collecting, tabulating, and publishing Federal statistics. The term "Core-Based Statistical Area" (CBSA) refer to the collective set of MSAs and MISAs. A MSA contains a core urban area of 50,000 or more population. A MISA contains an urban core of at least 10,000 (but less than 50,000) population. Each MSA or MISA consists of one or more counties and includes the counties containing the core urban area, as well as any adjacent counties that have a high degree of social and economic integration (as measured by commuting to work) with the urban core. The availability of data tabulated by MSA and MISA (and often less available for all counties or all cities) make MSAs and MISAs popular for the analysis of demographic, economic and business data. There are 508 metros included in the interactive table (as well as the U.S. and all states). Metros are included that have 65,000 population or more and for which ACS 2014 1-year estimates were developed. All data in the table, and integrated into the GIS project/datasets, are based on data from the ACS 2014 1-year estimates. These and additional subject matter items are included in the related demographic profile interactive tables. Support Using these Resources [goto top] Learn more about demographic economic data and related analytical tools. Join us in a Data Analytics Lab session. There is no fee for these Web sessions. Each informal session is focused on a specific topic. The open structure also provides for Q&A and discussion of application issues of interest to participants. ProximityOne User Group [goto top] Join the ProximityOne User Group to keep up-to-date with new developments relating to geographic-demographic-economic decision-making information resources. Receive updates and access to tools and resources available only to members. Use this form to join the User Group. Additional Information [goto top] ProximityOne develops geographic-demographic-economic data and analytical tools and helps organizations knit together and use diverse data in a decision-making and analytical framework. We develop custom demographic/economic estimates and projections, develop geographic and geocoded address files, and assist with impact and geospatial analyses. Wide-ranging organizations use our software, data and methodologies to analyze their own data integrated with other data. Follow ProximityOne on Twitter at www.twitter.com/proximityone. Contact ProximityOne (888-364-7656) with questions about data covered in this section or to discuss custom estimates, projections or analyses for your areas of interest. |

|

|