|

|

Regional Economic Information System - economic characteristics and patterns for the U.S. & each county & state

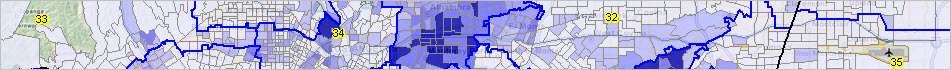

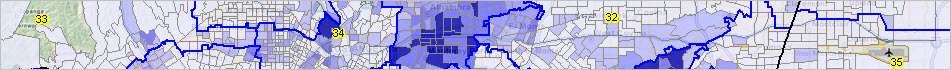

April 2025 — Here’s something that might surprise most Americans. Teton County, Wyoming, had the highest per capita personal income (PCPI) in 2022 at $406,054, marking a 56% increase since 2019, a trend explored in the county’s economic profile. How do we know this? In mid-November, the Bureau of Economic Analysis (BEA) updated its personal income estimates for 2022, and ProximityOne has applied this data to its Regional Economic Information System (REIS) to explore economic data not otherwise easily obtainable. Though the full updates are still underway, sample reports for selected counties are available, providing insights into economic trends and income patterns. Join our weekly web sessions every Tuesday at 3:00 pm ET to learn more about these data, their comparisons, and broader economic measures. The Bureau of Economic Analysis (BEA) has released the the 2022 annually updated personal income and related estimates by county (11/16/23). The ProximityOne Regional Economic Information System (REIS) has also been updated reflecting these BEA updates. This section has not yet been fully updated but here are sample reports for selected counties. Clicking a link opens the Economic Profile page for that county. From that page, navigate to related personal income pages for that county. Using REIS, these reports are also available in Excel format and for user selected years starting in 1969. Examine the profiles to learn more about economic makeup and trends in selected counties. REIS Economic Profiles; Selected Counties; Selected Dates (2019 & 2022) • Cowley County, KS • Fresno County, CA • Clark County, NV • Orange County, TX • San Diego County, TX • Washoe County, NV • Harris County, TX • Teton County, WY Comparing Personal Income (BEA) with Census (ACS/CPS ASEC/SAIPE) Income more about this topic below Regional Economic Information System The Regional Economic Modeling System (REIS) is a Windows-based integrated software and database developed to support regional demographic economic analysis. REIS has been developed, maintained and supported by ProximityOne/Warren Glimpse. The intended uses of REIS are to better understand regional demographic-economic conditions and and how changes in those conditions might impact their business/organization. Users include individuals, businesses, government agencies, colleges and universities, associations and other organizations. Collaborate with other users on topics ranging from operations, modeling, subject matter, policy topics, forecasting, impact analysis and related applications. The REIS database is primarily comprised of selected Federal statistical data and is updated frequently. REIS uniquely brings those disparate data together to facilitate modeling. REIS may be installed by authorized users at no fee. Request UserID. Run installer here. See terms of use. REIS Start-up View  REIS Database The REIS Database includes these U.S. by county time series. • Personal Income by Major Sources & related components (Annual, BEA) • GDP by Sector (Annual, BEA) • Quarterly Census Establishmnet, Employment, Wages QCEW (Annual/Quarterly,BLS) • Population by Age & Selected Attributes (Census) • Housing Attributes (census) Terms of Use Terms of Use .. There is no warranty, express or implied, for any aspect of use of the REIS installer, software or related data. The user is solely responsible for any use made of the REIS installer, software, data or use of resulting output. The user agrees not to distribute the REIS installer, software or related data installed with REIS installer.. Personal income is the income received by all persons from all sources .. the sum of net earnings by place of residence, property income, and personal current transfer receipts. Per Capita Personal Income (PCPI) is a comprehensive measure of personal economic well-being in an area. County level PCPI is the most geographically granular measure available. PCPI provides a more wholistic measure of income Estimated annually at the county level starting in the 1970s by BEA, BEA introduced county level estimates of GDP in the 2010s. This section is focused on personal income by major sources and related data. The Regional Economic Information System (REIS), originally focused on personal income by major sources, now more broadly includes GDP by sector. The regional economy is defined as one or more contiguous counties. Updated/extended annually by the Bureau of Economic Analysis (BEA), PCPI is derived from an extended set of related data. Use the interactive table below to examine U.S., state and county patterns of PCPI and related measures in context of the economic profile. The local area personal income data are updated/extended annually and released in November. The time series runs from 1969 through 2021 and updates with 2022 BEA-sourced estimates in November 2023. ProximityOne uses these data to develop current estimates (e.g., 2022) and projections to 2030. Visual Analysis of Per Capita Personal Income Patterns The following map shows patterns of economic prosperity, U.S. by county, based on in per capita personal income (PCPI) in 2019. Create variations of this view -- this view uses a layer in the "US1.GIS" GIS project installed by default with all versions of the CV XE GIS software.  - click graphic for larger view. - view developed with ProximityOne CV XE GIS software. Topics in this section • 01 About personal income and related measures. • 02 Interactive Table below. .. examine personal income characteristics & trends for areas of interest. • 03 Use the area profiles below. • 04 Use the VDA Web GIS to access/analyze personal income by county. • 05 Use the CV XE GIS tools & REIS GIS project; integrate your data. Personal income and its components, including statistics of earnings by industry, will be available online for all counties and metropolitan areas via VDA GIS later in the week of November 14, 2022. Access/analyze annual county/metro time series data through 2022. 2022 current estimates are developed by ProximityOne. Use these data to: • how, and why a county/regional economy is changing • in economic models to project tax revenues & demand for public utilities & services. • to determine areas for locating, expanding, and closing businesses. • to analyze the economic impact of a natural disaster. • to determine if an area has income/employment for economic development project. The Regional Economic Information System (REIS) integrates data from: • personal income and its components .. described here • GDP by sector .. updates released through 2022 in December 2022 Related Sections .. goto top • County Demographic-Economic Trends Main • Evolving, the Regional Demographic-Economic Information System includes these topics/data: .. this section .. Projections to 2060 .. Population & Components of Change: 2010 to 2020 .. Age-Race/Ethnicity-Gender 2010 to 2020 .. Demographic-Economic Profiles ACS2019 .. County to County Migration .. State & county GDP .. County Establishments, Employment & Earnings Characteristics Annual QCEW; detailed NAICS .. County Establishments, Employment & Earnings Characteristics Quartery QCEW; detailed NAICS .. State & Regional Income & Product Accounts NIPA-like Framework Area Profiles for Selected Areas .. goto top Tell a story, conduct a briefing session. Pick a topic and an audience. Use these profiles with the interactive table and GIS application, maybe with additional data, for a collaborative/stakeholder group session. Illustrative Story Outline/Steps • Choose a county (e.g., Fresno County, CA) Possibly start here: 1. importance of personal income by major sources to you. -- income that people get from wages, proprietors' income, dividends, interest, rents, and government benefits. -- residence adjusted personal income 2. In 2019, personal income increased in 2,964 counties, decreased in 139, and was unchanged in 10. 3. For the U.S. overall (get from Summary Characteristics from any US profile below) -- the population of United States changed from 309,321,666 (2010) to 328,239,523 (2019) a change of 18,917,857 (0.06%). -- the per capita personal income (PCPI) changed from $40,547 (2010) to $56,490 (2019) a change of $15,943 (39.32%). 4. For the Fresno County -- the population of Fresno County, CA changed from 932,039 (2010) to 999,101 (2019) a change of 67,062 (0.07%). -- the per capita personal income (PCPI) changed from $31,724 (2010) to $45,487 (2019) a change of $13,763 (43.38%) • Use VDA Web GIS (click to start, opens in a new page) to frame lay of the land (start with zip code 93720) -- here we review the "lay of the land" Suggested steps: -- in legend panel, click off metros and world by country. -- click on county outline, county name, county population, openstreetmaps layer. -- click -zoom button below map, adjusting view to this county and those adjacent. -- speak to geography and relative population sizes. -- done with VDA for now. • Use the Population & Components of Change table to compare county to state (e.g.,diversity) .. review the how and why the population has changed, 2010-2019 • Use the County Migration table to review origin/destination of movers • Use DEP (below) to compare Fresno County with CA (population, educational attainment, inoome, housing value) .. use the four pages/tables • Use the table on this page to view the CA30 economic profile • Use CA profiles (below) to show personal income components for county and state ... each of six a discussion possibility ... expand these steps Tables/Selected Profiles The following profiles are generated by the ProximityOne Regional Economio System Package. These profiles show how the area's personal income attributes have changed since 2010, Key: CA4 .. Personal Income & Employment by Major Component CA5 .. Personal Income by Major Component & Earnings by NAICS Industry CA25 .. Full & Part-time Employment by NAICS Industry CA30 .. Economic Profile CA35 .. Personal Current Transfer Payments CA45 .. Farm Income & Expenses DEP .. Demographic-Economic Profile

Measuring the Regional Economy and Change One important part of measuring the regional economy and change is access to personal Income and related components of change measures. Personal income is the income available to persons for consumption expenditures, taxes, interest payments, transfer payments to governments and the rest of the world, or for saving. Personal income is a broader measure of personal economic well-being than provided by the American Community Survey (ACS) money income. Personal income measures are developed using largely administrative data rather than ACS money income measures based on a statistical survey. Start with the CA4 Personal Income by Major Sources profile to examine the components of personal income and how it is computed. The CA4 profile for the U.S. Using the Interactive Table .. goto top The start-up view of the interactive table below shows 31 rows of economic characteristics for the U.S. for 2010, 2019, 2010-19 change and percent change. Use the Find GeoID button below the table to view a similar profile for any county or state. Use this table (related page) to locate the 5-character county code for any county. The 31 subject matter rows/items are a part of the economic profile shown below in this section. As summarized there, these 31 items show attributes of: • Place of residence profile -- Personal income (thousands of dollars) derivation • Per capita incomes (dollars) • Place of work profile -- Earnings by place of work • Total employment -- number of jobs by type • Average earnings per job (dollars) Economic Profile; 2010-2019 & Change; U.S. by County & State -- Interactive Table .. goto top Use mouseover on header column to view extended item/column name. Click ShowAll button between Find/Queries. See usage notes below table. See related geographic, demographic, economic interactive tables. Usage Notes • Data are included in the table for counties, states and the U.S. • For best view use a full window browser view. • Item code and name column values are shown in the table below. • Click ShowAll button between queries; this resets the table. • Click on a column header to sort on that column; click column header again to sort in other direction. • Click State to select on geographies in a selected state (click ShowAll between selections). • Select a state or county view: .. click ShowAll button; reset to default view. .. key in state FIPS code + county FIPS code in text box to right of Find-GeoID button .. the default value 48201 is for Harris County, TX (Houston); another example is 17031 (Ccok County, IL (Chicago) .. for the U.S. or a state, the "county code" is 000; for example, Texas is 48000 and Illinois is 17000 .. click Find GeoId button to display data for this area. • Select an item; view across geographies: .. click ShowAll button; reset to default view. .. select an item using the ItemCode dropdown below the table. .. for example, select 010 -- per capita personal income (PCPI) ... try that now, the table refreshes with rows showing only PCPI. ... click on a header column to sort on a selected year or change. • All counties with selected item; view across geographies: .. click ShowAll button; reset to default view. .. key in Item Code (see table below) in the text box to the right of "All Counties with Item>" button. .. the default value is 110 -- per capita personal income. .. click "All Counties with Item>" button to display selected item for all counties. • All states with selected item; view across geographies: .. click ShowAll button; reset to default view. .. key in Item Code (see table below) in the text box to the right of "All States with Item>" button. .. the default value is 110 -- per capita personal income. .. click "All States with Item>" button to display selected item for all states. Economic Profile Items .. goto top

1/ Consists largely of Supplemental Security Income (SSI) payments; Earned Income Tax Credits (EITC); family assistance; general assistance; expenditures for food under the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); Supplemental Nutrition Assistance Program (SNAP); and other assistance benefits. 2/ Rental income of persons includes the capital consumption adjustment. 3/ Census Bureau midyear population estimates. Estimates for 2010-2015 reflect county population estimates available as of March 2016. 4/ Type of income divided by population yields a per capita measure for that type of income. 5/ Includes actual employer contributions and actuarially imputed employer contributions to reflect benefits accrued by defined benefit pension plan participants through service to employers in the current period. 6/ Excludes limited partners. All dollar estimates are in current dollars (not adjusted for inflation). BEA County Geographic Modifications .. goto top In some cases, BEA collapsed data for selected county and county-equivalent areas. These modifications affect Hawaii, Virginia and Wisconsin. Only Virginia is affected is a significant manner. For example, BEA combines data for the true county areas of Fairfax, VA (51059), Fairfax City (Independent City), VA (51600) and Falls Church (Independent City), VA (51610) into the grouped area "Fairfax County, Fairfax City + Falls Church, VA" with FIPS pseudo code 51919. BEA modified areas are shown in this XLS table. Scope of the REIS Subject Matter .. scroll section .. goto top The REIS data are organized into eight subject matter groups. The interactive table shown above is one of these six groups. In total there are approximately 375 annual subject matter series running annually 2001-2017. ProximityOne develops estimates and projections for the period 2018-2030 for each of these series. • E01 Establishments by NAICS Industry • E04 Personal Income and Employment by Major Component • E05 Personal Income by Major Component and Earnings by NAICS Industry • E06 Compensation of Employees by NAICS Industry • E25 Employment by NAICS Industry • E30 Economic Profile • E35 Personal Current Transfer Receipts • E45 Farm Income and Expenses • E91 Gross Flow of Earnings E04. Personal Income and Employment by Major Component .. goto Scope TOC

E05. Personal Income by Major Component and Earnings by NAICS Industry .. goto Scope TOC

E06. Compensation of Employees by NAICS Industry .. goto Scope TOC

E25. Total Full-Time and Part-Time Employment by NAICS Industry .. goto Scope TOC

E30. Economic Profile .. goto Scope TOC

E35. Personal Current Transfer Receipts .. goto Scope TOC

E45. Farm Income and Expenses .. goto Scope TOC

E91. Gross Flow of Earnings .. goto Scope TOC

Comparing Local Area Personal Income (BEA/LAPI) with Census (ACS/CPS ASEC/SAIPE) .. goto top under development & will be transitioned to a separate section This section is focused mainly on county level estimates of annual per capita personal income (BEA) and per capita/household money income (Census). The Census CPS ASEC, often considered a primary source of data on household income, is not of sufficient size to produce estimates at the county level. Comparing Teton County, WY .. under development Geography BEA .. all counties except for cities in mainly Virginia that are normally treated as county equivalents. .. these data are considered an annual time series Census .. all counties Time frame BEA -- annually released for "all" counties in November; data for 2022 released November 2023 and so on. Census ACS -- annually released for all counties in December as "5-year estimates"; data for 2018-2022 released December 2023 and so on. .. the "2022" estimates are based on a 5-year period and centric to 2020. .. the "5-year estimates" are not considered and annual time series from year to year. .. for counties over 65,000, "1-year estimate" are released in September. - the 2022 "1-year estimates" are comparable time-wise to the BEA 2022 estimates. Subject matter BEA .. PCPI derived from a complex chain of mainly administrative personal income components data .. PCPI is a major indicator whereas Median Household Income is a major indicator for Census ACS .. PCPI is neither topcoded nor suppressed. .. a median concept does not apply to LAPI/PCPI .. includes many sources of income not included in Census ACS measure. .. generally not possible to compute measures of reliablility. .. no related demographics available. Census .. based on ACS household survey. .. MHI is a major indicator whereas PCPI a major indicator for BEA LAPI .. MHI is topcoded and frequently suppressed. .. errors of estimate routinely computed and released. - for most counties these errors of estimation intervals are so wide they are not useful. .. extensive array of related demographic. Access & Usage .. under development More See more .. to be updated/adapted More About the REIS Data .. scroll section .. goto top

REIS estimates are developed by the U.S. Bureau of Economic Analysis based on

data from the Census Bureau, Bureau of Labor Statistics and other sources.

This section describes the legacy REIS, focused on personal income.

Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Net earnings is earnings by place of work (the sum of wages and salaries, supplements to wages and salaries, and proprietors income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Property income is rental income of persons, personal dividend income, and personal interest income. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for price changes). Per capita personal income is calculated as the personal income of the residents of a given area divided by the Census Bureau estimate of the resident population of the area. Place of Residence and Place of Work. Personal income, by definition, is a measure of the income received by persons, and the estimates of state and county personal income should reflect the residence of the income recipients. However, some of the data that are used to estimate some components of personal income are reported by the recipient's place of work rather than by his place of residence. Therefore, these components are estimated on a place-of-work basis, the amounts aggregated, and the aggregate (called the income subject to adjustment) adjusted to a place-of-residence basis. Thus the combination of the components of personal income plus the residence adjustment yields personal income on a place-of-residence basis. The estimates of wages and salaries, supplements to wages and salaries, and contributions for government social insurance (by employers and employees) are mainly derived from data that are reported by place of work. These data are reported by industry in the state and county in which the employing establishment is located. The estimates of nonfarm proprietors' income and contributions for government social insurance (by the self-employed) are derived from source data that are reported by the tax-filing address of the recipient. This address is usually that of the proprietor's residence; therefore, these data are assumed to be reported by place of residence. The estimates of farm proprietors' income are derived from data that are reported by the principal place of production, which is usually the county in which the farm has most of its land and in which most of the work is performed. Because most farm proprietors live on, or near, their land, the place of residence is assumed to be the same as the place of work. The estimates of rental income of persons, personal dividend income, personal interest income, personal current transfer receipts, and contributions for supplementary medical insurance and for veterans' life insurance are derived from data that are reported by the place of residence of the income recipient. Support Using these Resources .. goto top Learn more about accessing and using demographic-economic data and related analytical tools. Join us in a Data Analytics Lab session. There is no fee for these one-hour Web sessions. Each informal session is focused on a specific topic. The open structure also provides for Q&A and discussion of application issues of interest to participants. ProximityOne User Group Join the ProximityOne User Group to keep up-to-date with new developments relating to geographic-demographic-economic decision-making information resources. Receive updates and access to tools and resources available only to members. Use this form to join the User Group. Additional Information ProximityOne develops geographic-demographic-economic data and analytical tools and helps organizations knit together and use diverse data in a decision-making and analytical framework. We develop custom demographic/economic estimates and projections, develop geographic and geocoded address files, and assist with impact and geospatial analyses. Wide-ranging organizations use our tools (software, data, methodologies) to analyze their own data integrated with other data. Follow ProximityOne on Twitter at www.twitter.com/proximityone. Contact ProximityOne (888-364-7656) with questions about data covered in this section or to discuss custom estimates, projections or analyses for your areas of interest. |

|

|